3QFY2019 Result Update | Kitchen Appliances

January 29, 2019

TTK Prestige

Accumulate

CMP

`7,671

Performance Update

Target Price

`8,200

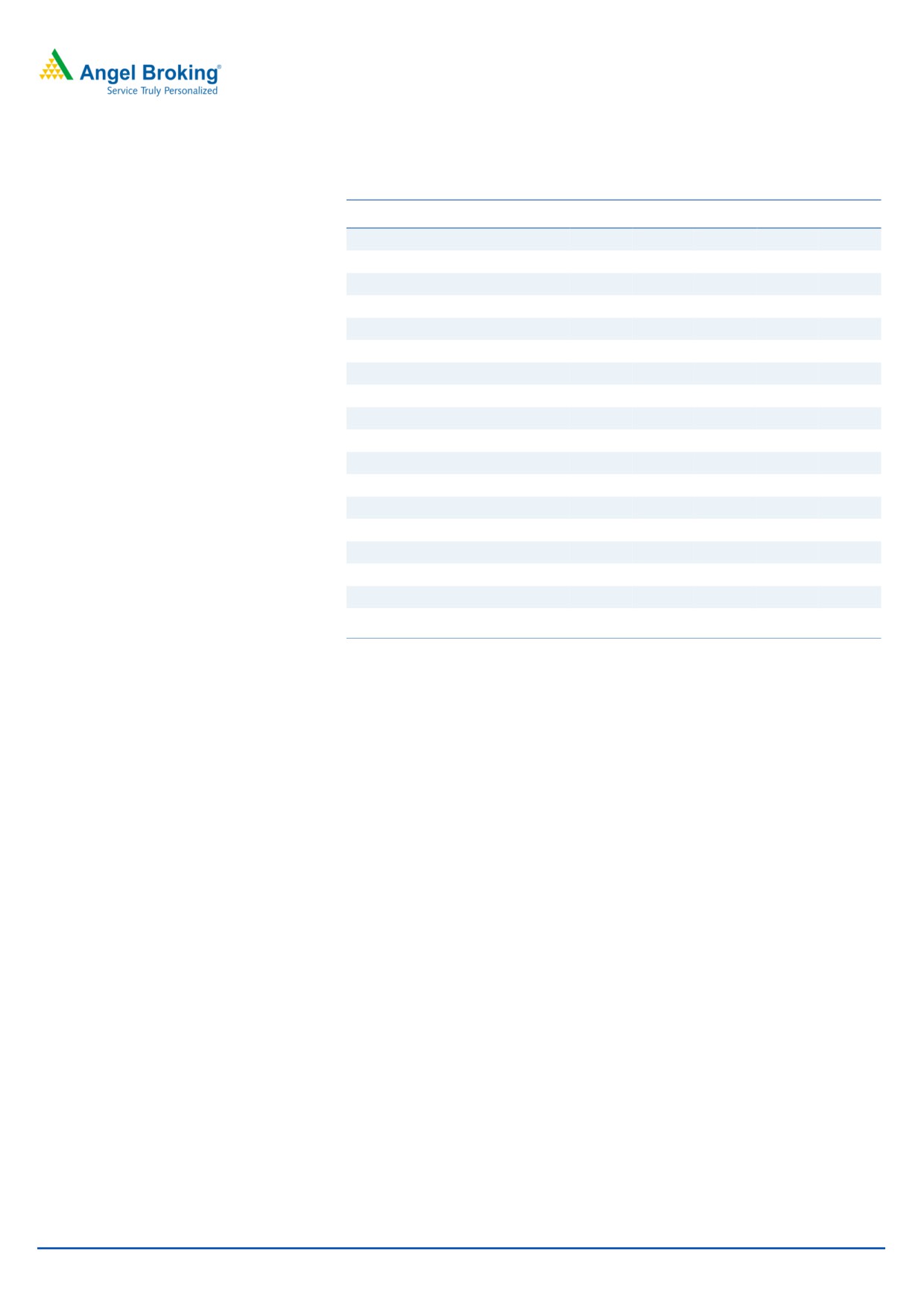

Y/E March (` cr)

Q3FY18

Q3FY19

YoY %

Q2FY19

QoQ%

Investment Period

12 Months

Net sales

458.0

552.0

20.5%

552.3

0.0%

EBITDA

66

85

28.3%

81

5.3%

Stock Info

EBITDA margin

14.5%

15.5%

14.7%

Sector

Kitchen Appliances

(%)

Adjusted PAT

43.7

56.8

30.2%

53.8

5.7%

Market Cap (` cr)

8,867

For Q3FY2019, TTK Prestige (TTK) posted decent performance with 20.5%/30%

Net Debt (` cr)

-

yoy growth in revenue/ PAT led by 100 bps expansion led by robust growth across

Beta

0.7

various product categories specially appliances and cookware.

52 Week High / Low

8100/5500

Revenue rose 7.2%: Q3’s top-line increase was also due to low base effect where

Avg. Daily Volume

2,489

last year, third quarter was little subdued after strong GST restocking happened in

Face Value (`)

10

Q2FY2018. Overall, cookers segment grew by 14% and appliances segment

BSE Sensex

35,593

grew by 29% yoy while cookware sales grew by 29% yoy. It sales is likely to

Nifty

10,652

remain buoyant driven by the strong new LPG connection under Ujjawala scheme

Reuters Code

TTKL.BO

and newly launched category like cleaning solutions and exports.

Bloomberg Code

TTKPT.IN

Margins improved by 100 bps: Its margin were the highest in the past at least 12

quarters at 15.5% due to better product mix, lower outsourcing and operating

Shareholding Pattern (%)

leverage. The company expects to maintain 14-15% margin profile on the back of

Promoters

70.4

improving product mix and distribution network.

MF / Banks / Indian Fls

9.6

Outlook and Valuation: We have maintained our earnings estimates in view of

FII / NRIs / OCBs

8.9

robust revenue outlook and stable operating margin in view of robust M9

Indian Public / Others

11.2

performance. We expect TTK to report a CAGR of~16%/23% in revenue/

earnings over FY18-20E. The stock is currently trading at 36x its FY2020

earnings. After our initiation in August 2018, the stock has given decent

Price Chart

appreciation of 22% and now looks fairly valued. Hence, we maintain Accumulate

10,000

9,000

and target price of `8200 (38x FY2020E EPS).

8,000

7,000

6,000

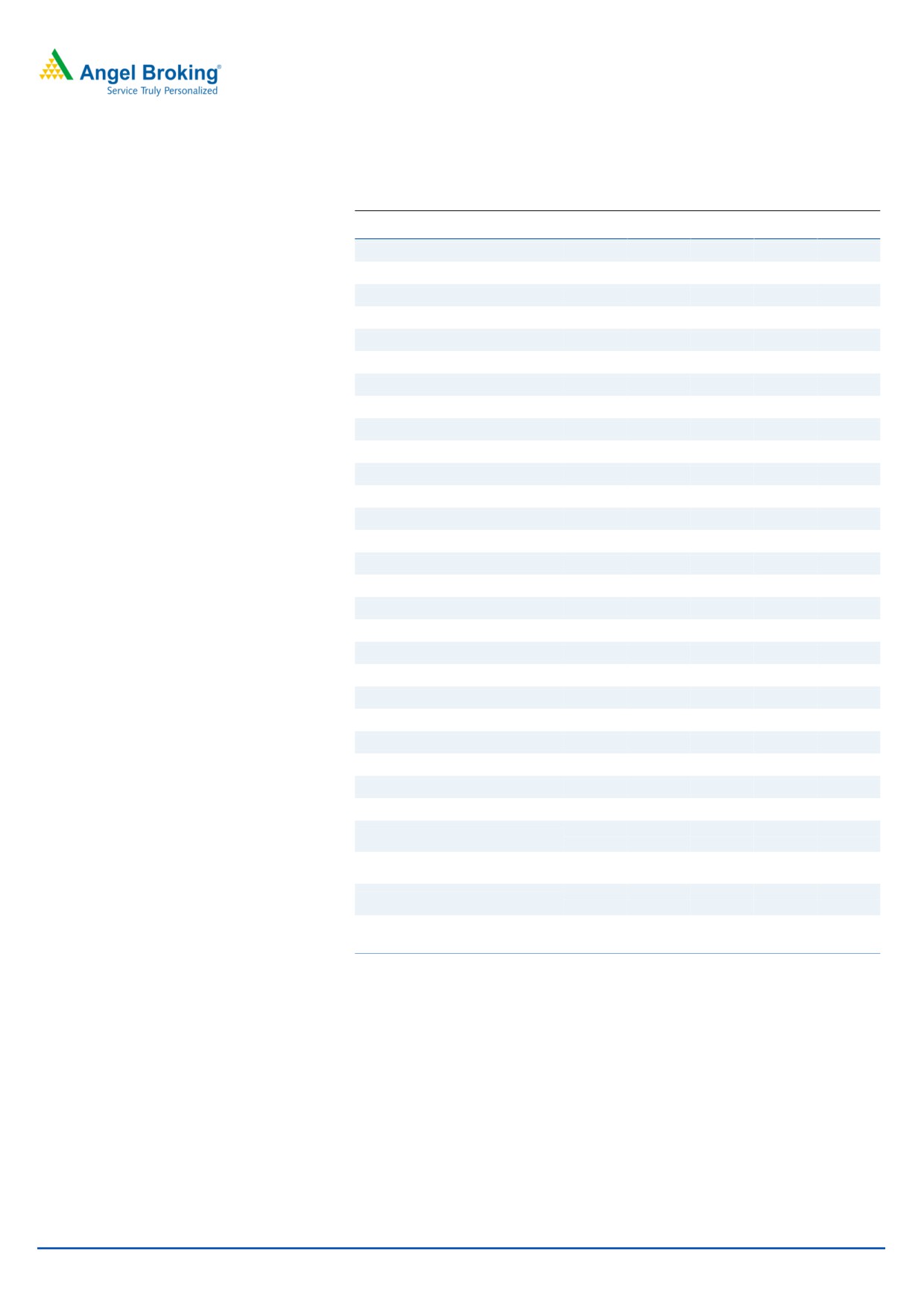

Key Financials

5,000

4,000

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E

FY2020E

3,000

2,000

Net Sales

1,559

1,837

1,982

2,254

2,649

1,000

% chg

12.3

17.8

7.9

13.8

17.5

0

Net Profit

115.6

150.7

164.5

205.5

247.1

% chg

25.2

30.3

9.2

24.9

20.3

OPM (%)

11.8

11.4

12.7

14.1

14.3

Source: Company, Angel Research

EPS (Rs)

100.0

130.3

142.3

177.8

213.8

P/E (x)

76.7

58.9

53.9

43.1

35.9

Nidhi Agrawal

P/BV (x)

9.4

7.9

6.6

5.7

4.9

022 - 3935 7800 Ext: 6872

RoE (%)

16.0

17.6

16.1

17.3

17.8

RoCE (%)

22.4

19.0

19.6

22.0

22.7

EV/Sales (x)

5.6

4.8

4.4

3.8

3.2

EV/EBITDA (x)

47.9

42.1

34.7

27.2

22.7

Source: Company, Angel Research

Please refer to important disclosures at the end of this report

1

TTK Prestige |3QFY2019 Result Update

Exhibit 1: Q3FY2019 Performance

In ` Cr

Q3FY18

Q2FY19

Q3FY19

YOY Growth QoQ growth

M9FY18

M9FY19

YOY

Total Income

458

552

552

20.5%

0.0%

1330

1523

14.5%

Total Expenditure

392

471

467

19.2%

-1.0%

1,153

1,301

12.9%

Raw Material Consumed

100

125

129

29.3%

2.8%

299

368

23.2%

Stock Adjustment

-31

18

-49

57.9%

-378.1%

7

-35 -615.0%

Purchase of Finished Goods

193

176

235

21.6%

33.1%

466

540

16.0%

COGS

262

319

315

20.3%

-1.3%

771

873

13.2%

Employee Expenses

34

40

44

30.0%

9.9%

98

122

24.4%

Other Expenses

95

112

107

12.5%

-3.9%

284

306

8.0%

Total Expenditure

392

471

467

19.2%

-1.0%

1153

1301

12.9%

EBITDA

66.5

81.0

85.3

28.3%

5.3%

177.0

221.7

25.3%

Other Income

3.7

6.4

6.6

80.8%

2.5%

136.8

17.7

-87.0%

Interest

0.5

0.7

0.5

15.2%

-19.7%

1.4

1.5

7.1%

PBDT

69.7

86.8

91.4

31.2%

5.3%

312.4

238.0

-23.8%

Depreciation

6.2

6.5

6.5

5.3%

0.2%

18.6

19.3

3.8%

PBT

63.5

80.3

84.9

33.7%

5.7%

293.9

218.7

-25.6%

Tax

19.8

26.5

28.0

41.4%

5.8%

74.4

72.2

-2.9%

Reported Profit After Tax

43.7

53.8

56.8

28.4%

5.7%

219.5

146.5

-33.2%

Extra-ordinary Items

102.2

Adjusted PAT

43.7

53.8

56.8

28.4%

5.7%

117.3

146.5

24.9%

Ratios

EBITDA margin (%)

14.5%

14.7%

15.5%

13.3%

14.6%

PAT margin %

9.5%

9.7%

10.3%

16.5%

9.6%

Tax rate %

31.2%

33.0%

33.0%

25.3%

33.0%

Source: Company, Angel Research

Risks to our estimates

Abrupt fluctuations in its primary raw materials- Aluminum and steel whose prices

are linked to global commodity prices. Although the company has been able to

pass on the increase in raw material prices to consumers in the past owing to a

strong brand, any failure to do so in the future can adversely impact operating

margins.

Foreign exchange movement- The company imports raw materials and finished

goods from outside India as well as makes export sales to countries outside the

territories in which they operate from which exposes it to foreign currency risk.

Foreign currency exchange risks are managed by entering into forward contracts

against foreign currency vendor payables.

Excessive competition/ pricing war - TTK is competing with many different players

in different category. Many foreign players are also entering Indian markets which

could lead aggressive competition, pricing war. So far, TTK has gained market

share from its competition over the years with its innovative culture and growth

strategies.

January 29, 2019

2

TTK Prestige |3QFY2019 Result Update

Profit & Loss Statement

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019E FY2020E

Total operating income

1,559

1,837

1,982

2,254

2,649

% chg

12.3

17.8

7.9

13.8

17.5

Total Expenditure

1,376

1,627

1,731

1,936

2,271

Raw Material

931

1,085

1,124

1,274

1,492

Personnel

114

138

159

176

207

Selling and Administration Expenses

313.8

374.0

421.0

462.1

543.0

Others Expenses

17

31

27

25

29

EBITDA

183

210

251

318

378

% chg

20.0

14.5

19.5

26.8

18.9

(% of Net Sales)

11.8

11.4

12.7

14.1

14.3

Depreciation& Amortisation

21

26

26

28

32

EBIT

162

184

225

290

346

% chg

21.4

13.4

22.3

28.6

19.3

(% of Net Sales)

10.4

10.0

11.4

12.8

13.0

Interest & other Charges

6

11

7

7

7

Other Income

10

11

141

20

25

(% of PBT)

6.2

5.9

39.4

6.6

6.9

Share in profit of Associates

-

-

-

-

-

Recurring PBT

167

184

359

302

363

% chg

25.1

10.2

95.3

(15.8)

20.3

Tax

51

33

96

97

116

(% of PBT)

30.7

18.1

26.6

32.0

32.0

PAT (reported)

116

151

263

206

247

Extraordinary Items

-

-

99

-

-

Less: Minority interest (MI)

0

0

0

0

0

PAT after MI (reported)

115

150

263

205

247

ADJ. PAT

116

151

165

206

247

% chg

25.2

30.3

9.2

24.9

20.3

(% of Net Sales)

7.4

8.2

8.3

9.1

9.3

Fully Diluted EPS (Rs)

100.0

130.3

142.3

177.8

213.8

% chg

25.2

30.3

9.2

24.9

20.3

January 29, 2019

3

TTK Prestige |3QFY2019 Result Update

Consolidated Balance Sheet

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019

FY2020

SOURCES OF FUNDS

Equity Share Capital

12

12

12

12

12

Reserves& Surplus

711

842

1,008

1,175

1,381

Shareholders Funds

723

854

1,020

1,187

1,392

Equity Share Warrants

-

-

-

-

-

Total Loans

-

113

129

129

129

Deferred Tax Liability

-

-

-

-

-

Other liabilties

6.8

6.3

5.4

5.4

5.4

Total Liabilities

730

973

1,154

1,322

1,527

APPLICATION OF FUNDS

Gross Block

351

567

598

688

778

Less: Acc. Depreciation

21

58

108

137

169

Net Block

330

510

490

552

609

Capital Work-in-Progress

3

2

4

4

4

Investments

68

75

167

167

167

Current Assets

583

680

880

1,035

1,256

Inventories

325

380

437

497

584

Sundry Debtors

175

215

258

294

345

Cash

31

65

136

188

261

Loans & Advances

52

20

49

56

66

Other Assets

-

-

-

-

-

Current liabilities

238

281

373

423

496

Net Current Assets

346

400

507

612

761

Deferred Tax Asset

(29)

(35)

(42)

(42)

(42)

Total Assets

730

973

1,154

1,322

1,527

January 29, 2019

4

TTK Prestige |3QFY2019 Result Update

Cash Flow Statement

Y/E March (` cr)

FY2016

FY2017

FY2018

FY2019

FY2020

Profit before tax

167

184

359

302

363

Depreciation

21

26

26

28

32

Change in Working Capital

(64)

(70)

(47)

(53)

(76)

Interest / Dividend (Net)

9

(0)

(6)

7

3

Direct taxes paid

(36)

(37)

(93)

(97)

(116)

Others

(19)

(9)

(112)

1

5

Cash Flow from Operations

78

94

127

188

211

(Inc.)/ Dec. in Fixed Assets

(17)

(26)

(12)

(90)

(90)

(Inc.)/ Dec. in Investments

11

(142)

9

20

25

Cash Flow from Investing

(6)

(168)

(3)

(70)

(65)

Issue of Equity

0

0

0

0

0

Inc./(Dec.) in loans

0

113

0

0

0

Dividend Paid (Incl. Tax)

0

0

0

0

0

Interest / Dividend (Net)

(2)

(8)

(75)

39

(31)

Cash Flow from Financing

(71)

106

(113)

0

(73)

Inc./(Dec.) in Cash

2

31

11

119

73

Opening Cash balances

25

27

58

69

188

Closing Cash balances

27

58

69

188

261

Source: Angel Research, Company

January 29, 2019

5

TTK Prestige |3QFY2019 Result Update

Key Ratios

Y/E March

FY2016

FY2017

FY2018

FY2019

FY2020

Valuation Ratio (x)

P/E (on FDEPS)

76.7

58.9

53.9

43.1

35.9

P/CEPS

49.5

38.3

23.4

28.9

24.2

P/BV

9.4

7.9

6.6

5.7

4.9

Dividend yield (%)

0.3

0.4

0.4

0.4

0.5

EV/Sales

5.6

4.8

4.4

3.8

3.2

EV/EBITDA

47.9

42.1

34.7

27.2

22.7

EV / Total Assets

12.0

9.1

7.5

6.5

5.6

Per Share Data (`)

EPS (Basic)

100.0

130.3

142.3

177.8

213.8

EPS (fully diluted)

100.0

130.3

142.3

177.8

213.8

Cash EPS

118.1

152.6

250.1

202.2

241.7

DPS

22.0

27.0

30.0

33.0

36.3

Book Value

625.5

738.4

882.1

1,026.9

1,204.4

Dupont Analysis

EBIT margin

10.4

10.0

11.4

12.8

13.0

Tax retention ratio

0.7

0.8

0.7

0.7

0.7

Asset turnover (x)

2.5

2.2

2.3

2.3

2.4

ROIC (Post-tax)

18.0

18.2

19.5

20.5

21.5

Cost of Debt (Post Tax)

0.0

0.1

0.0

0.0

0.0

Returns (%)

ROCE

22.4

19.0

19.6

22.0

22.7

Angel ROIC (Pre-tax)

26.0

22.3

26.6

30.1

31.6

ROE

16.0

17.6

16.1

17.3

17.8

Turnover ratios (x)

Asset Turnover (Gross Block)

4.4

3.2

3.3

3.3

3.4

Inventory / Sales (days)

76

75

81

81

81

Receivables (days)

41

43

48

48

48

Payables (days)

93

94

121

121

121

Working capital cycle (ex-cash)

(days)

24

24

7

7

7

Source: Company, Angel Research

January 29, 2019

6

TTK Prestige |3QFY2019 Result Update

Research Team Tel: 022 - 39357800

DISCLAIMER:

Angel Broking Limited (hereinafter referred to as “Angel”) is a registered Member of National Stock Exchange of India Limited, Bombay

Stock Exchange Limited, Metropolitan Stock Exchange Limited, Multi Commodity Exchange of India Ltd and National Commodity &

Derivatives Exchange Ltd It is also registered as a Depository Participant with CDSL and Portfolio Manager and Investment Adviser with

SEBI. It also has registration with AMFI as a Mutual Fund Distributor. Angel Broking Limited is a registered entity with SEBI for Research

Analyst in terms of SEBI (Research Analyst) Regulations, 2014 vide registration number INH000000164. Angel or its associates has not

been debarred/ suspended by SEBI or any other regulatory authority for accessing /dealing in securities Market. Angel or its

associates/analyst has not received any compensation / managed or co-managed public offering of securities of the company covered

by Analyst during the past twelve months.

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment

decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make

such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies

referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and

risks of such an investment.

Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and

trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's

fundamentals. Investors are advised to refer the Fundamental and Technical Research Reports available on our website to evaluate the

contrary view, if any

The information in this document has been printed on the basis of publicly available information, internal data and other reliable

sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this

document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way

responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report.

Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify,

nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While

Angel Broking Limited endeavors to update on a reasonable basis the information discussed in this material, there may be regulatory,

compliance, or other reasons that prevent us from doing so.

This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced,

redistributed or passed on, directly or indirectly.

Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in

connection with the use of this information.

Disclosure of Interest Statement

TTK Prestige

1. Financial interest of research analyst or Angel or his Associate or his relative

No

2. Ownership of 1% or more of the stock by research analyst or Angel or associates or

No

relatives

3. Served as an officer, director or employee of the company covered under Research

No

4. Broking relationship with company covered under Research

No

Ratings (Based on Expected Returns:

Buy (> 15%)

Accumulate (5% to 15%)

Neutral (-5 to 5%)

over 12 months investment period)

Reduce (-5% to -15%)

Sell (< -15%)

January 29, 2019

7